Trusted by Industry Leaders

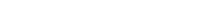

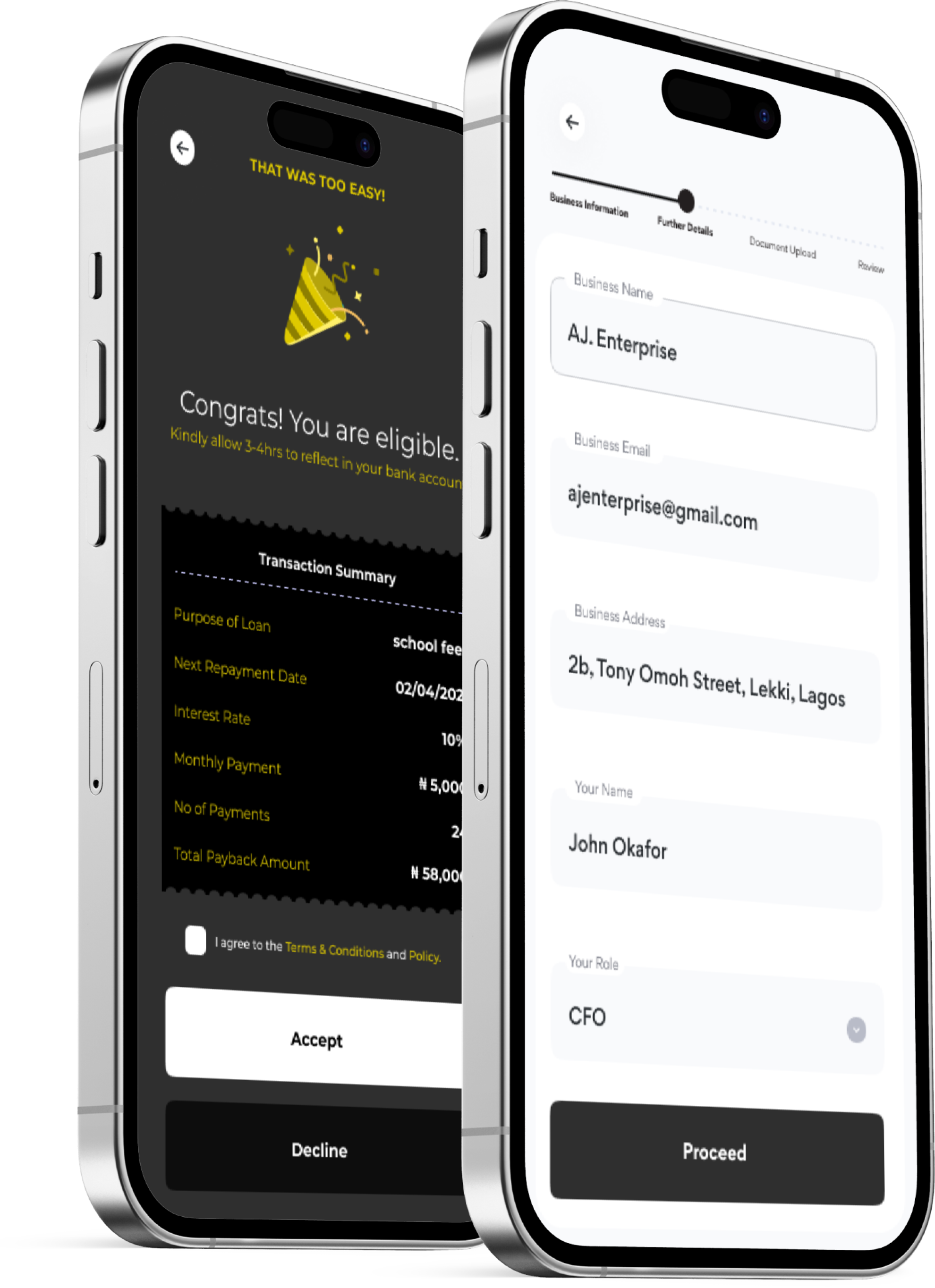

Aterise is the preferred choice for banks, financial institutions, insurers, and global Fintech players, earning their trust through reliable solutions.

With over 7 years of experience, Aterise has consistently delivered robust solutions to innovators and industry leaders. Our track record speaks for itself.