Industry: FinTech, Digital assets exchange / Crypto / Blockchain

Location: Switzerland, Liechtenstein, Germany

Employees: Over 50

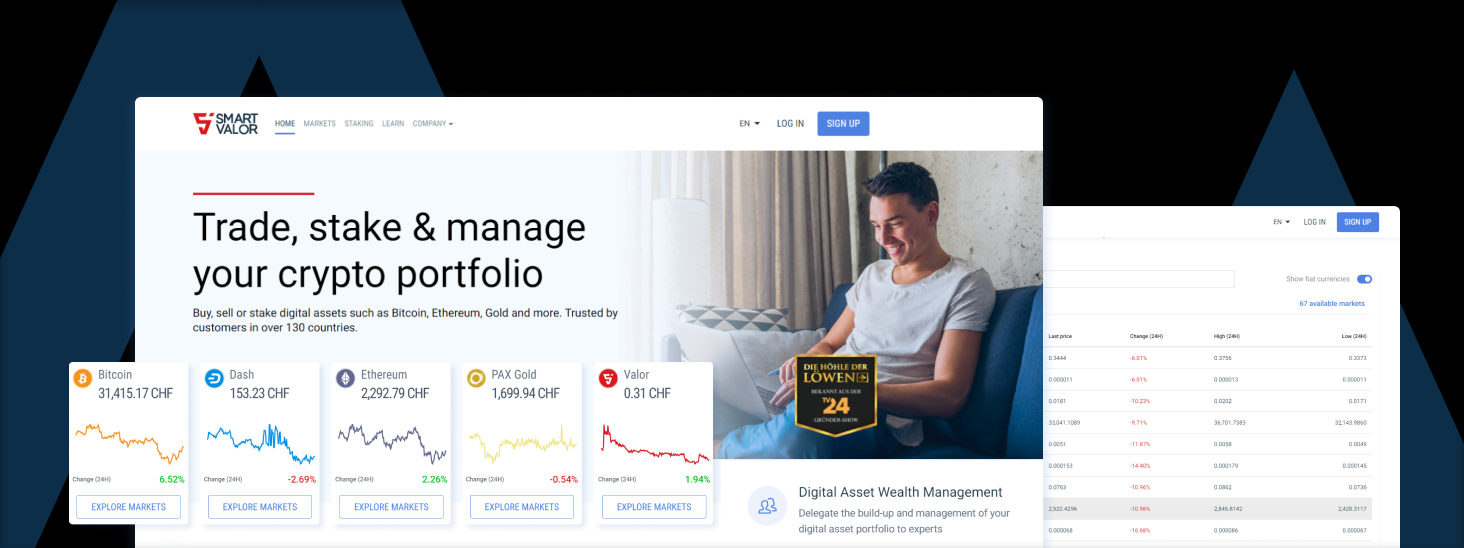

Smart Valor is the first crypto exchange to debut in Liechtenstein in 2019 and the first to gain regulator approval for custody and exchange under the new FMA’s Blockchain Act

Smart Valor is a Swiss company operating a full-service digital asset exchange for trading, custody, staking and issuance which serves the European, Asian, and South American markets. Founded in 2017, the company is backed by leading institutional investors such as Venture Incubator funded by global Swiss brands such as Credit Suisse and Nestle.

Сryptotokens is taking over the digital world. The digital and physical worlds have been existing in separate realms for a long time. The base concept our client is working on is to create a link between the digital and physical worlds, making assets digital and liquid and democratizing investor access in the process.

SMART VALOR was one of the first companies to adopt tokenization and decentralized finance (DeFi) when it was founded in the Swiss Crypto Valley in 2017. Forbes named SMART VALOR as one of Europe’s 10 Most Exciting Technology SMEs, and the company is currently leading the way with its 100% regulations-compliant cryptocurrency exchange and digital asset marketplace.

Aterise has introduced a strategic plan for product and project team development. We have performed an insightful discovery phase that allowed for a highly effective project kick-off. This also included a well-structured team setup and ambitious ramp-up plan to productively realize the envisioned concepts and solutions by a committed team of engineers. Thanks to vast experience in the Fintech space and knowledge of the industry supported with a highly proactive discovery, we earned the trust of the customer and were selected in a challenging competition among multiple IT companies from all over Europe.

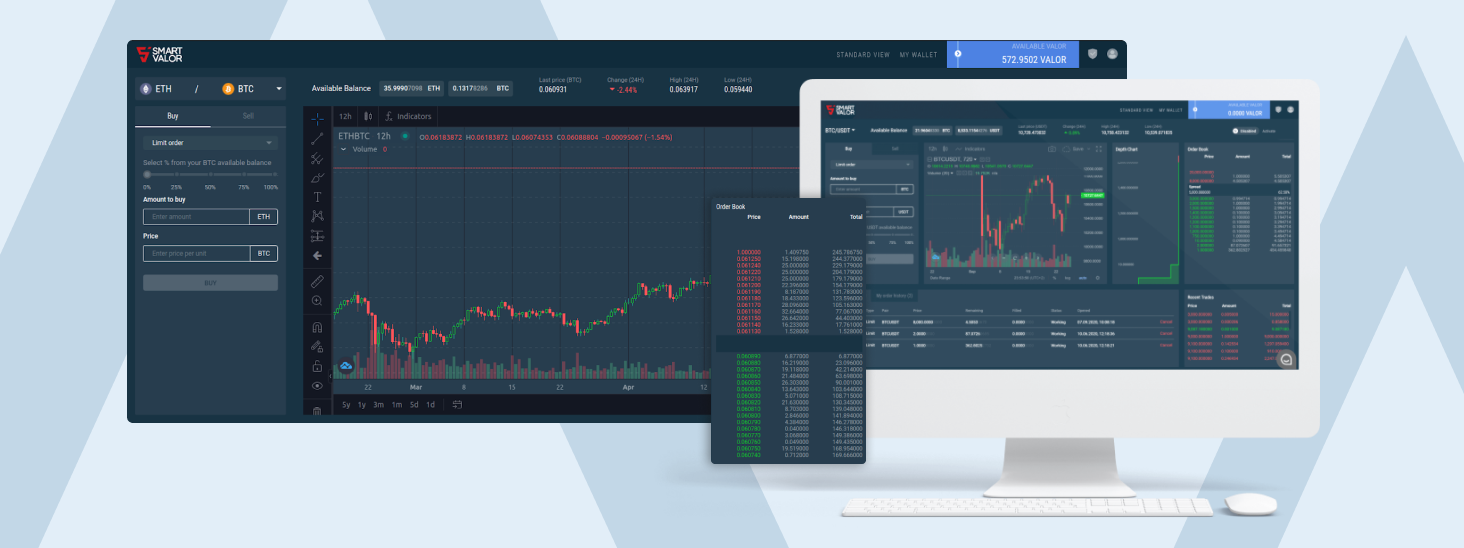

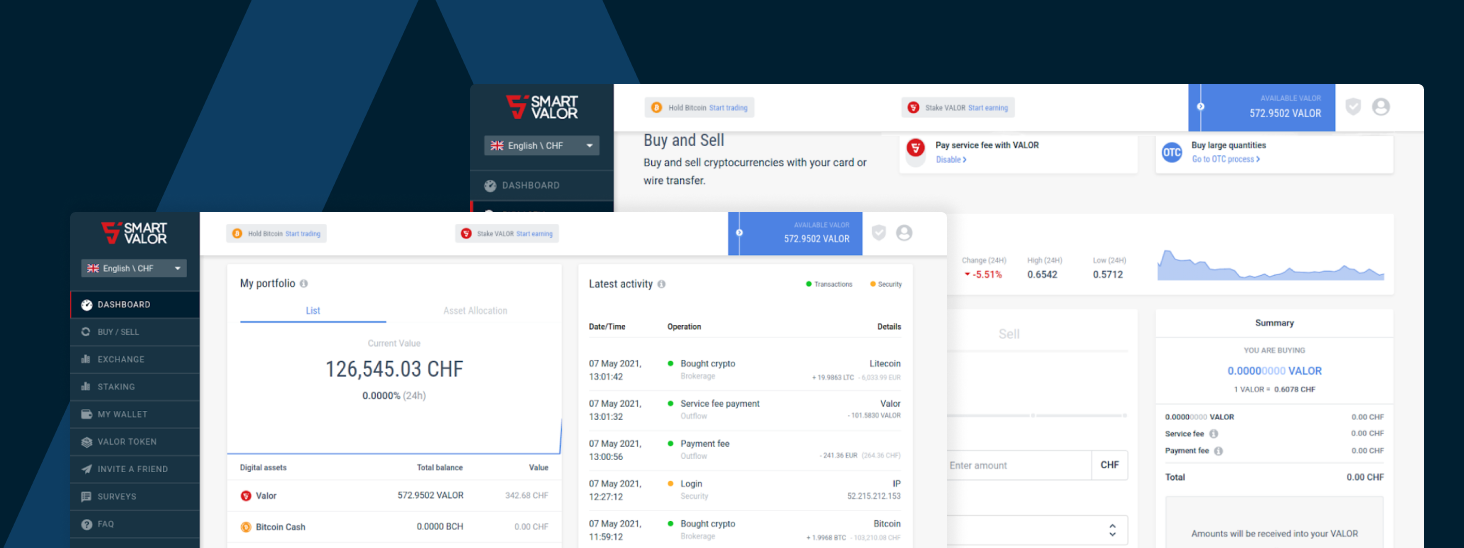

Aterise was tasked to develop and implement new features and services, enrich the existing UI, and increase productivity of the rapidly evolving software product taking into account regulatory requirements (FINMA in Switzerland and FMA in Liechtenstein) during implementation of a highly scalable solution.

Another big chunk of the scope was to automate the Client’s internal business processes in order to optimize employee performance.

One of the major challenges of the engagement was the very high technological complexity of the product, which required from any vendor a top level of architectural and technical maturity.

The mission we have been focusing on from the early beginning is refining and building high-priority features that generate core business value — brokerage mechanics and cryptocurrency exchange. This focus required a constant attention to a multiple jobs and factors:

To accomplish the objective, Aterise successfully took over a number of important project tasks:

Following the strategic product roadmap and the prioritized backlog, Aterise allocated a dedicated team of skilled software engineers who are currently working full-time on the project. The team is evolving and expanding to meet the CPO and CTO demands and the company’s objectives.

Upon successful integration of the Aterise team and its solutions into the Smart Valor processes, a number of bottlenecks were resolved and the development process was streamlined significantly, which allowed for accelerated feature implementation.

The platform has been able to acquire new users more efficiently and demonstrated substantial growth over the 3 months after the features had been implemented and as a result significantly offloaded effort from organisation operations. Currently, we are working proactively on further product improvements in close collaboration with our customer’s professional team.